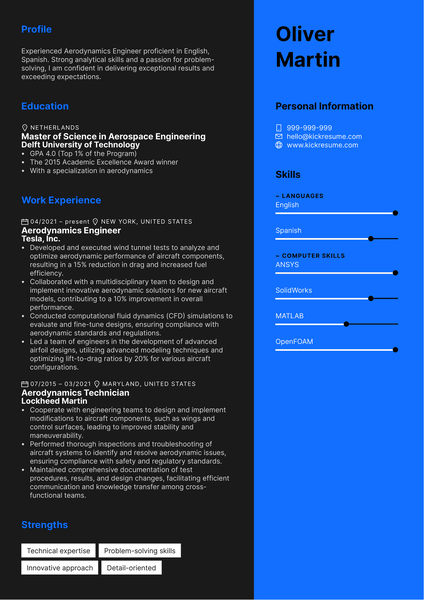

Crafting a compelling aerospace engineer resume doesn't have to be rocket science! Certainly not with our easy-to-follow guide, which brings you all the best tips, examples, and templates to help your resume shine. So, dive right in and make yourself a resume to remember.

Keep reading to learn how to:

- Choose the correct resume format for the position

- Write a compelling and eye-catching resume summary

- Include a variety of key aerospace engineering skills

- Describe past work experience using concise bullet points

- List aerospace engineering educational credentials accurately

- Access top resources for job-seeking aerospace engineers

Still looking for a job? These 100+ resources will tell you everything you need to get hired fast.

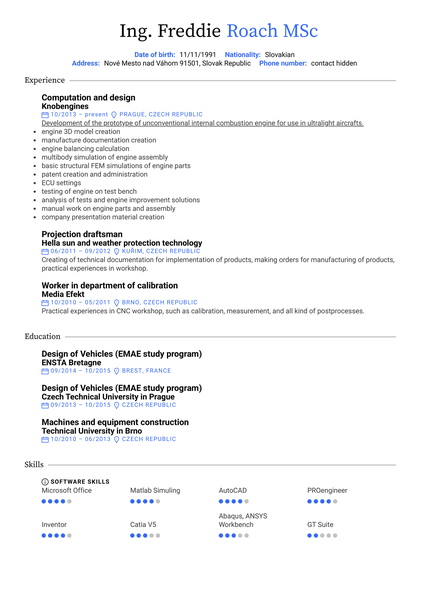

1. Choose the correct resume format for your aerospace engineer resume

The first big decision to make before you even start writing your aerospace engineering resume is what type of resume format will be best.

Generally, to earn this position you will need a format that focuses on work experience, known as the reverse-chronological resume. This format heavily emphasizes formal work experience, listing your most recent job first and working backward from there.

However, if you lack formal work experience in the field of aerospace engineering, you may need to consider one of the following alternative formats:

- Functional Resumes: Functional resumes do not focus on work experience – instead, they emphasize education, skills, and unpaid experience. This format works well for current students or recent graduates with an extensive educational history but limited professional work history.

- Hybrid Resumes: Hybrid resumes do not focus on any section in particular, but rather spread the focus of the document out between all sections. This format is well-suited for engineers who are changing career paths or disciplines, or applicants who are returning from a gap in their career.

Choose your preferred template and make your resume shine.

2. Write a compelling and eye-catching resume summary

A resume summary is a short introductory statement that showcases your best professional attributes and accomplishments.

By including a summary at the top of your resume, you can better stand out from the competition and make your resume memorable to employers.

As your write your summary, it is important to consider what the most impressive details of your career are and include them in this statement.

To illustrate how to write an effective summary, below is a weak example followed by a correction and explanation:

Incorrect aerospace engineer resume summary example

Newly graduated Aerospace Engineer with over a year’s experience working as an intern for Boeing. Skilled in systems design and testing, as well as being highly adept at using 2D and 3D CAD modeling and design software. Winner of university’s Innovation in Undergraduate Engineering competition.

Why is this incorrect?

While the information presented in this summary is not necessarily bad, it needs more contextualization to be compelling and effective. To improve this summary, the applicant should provide greater detail about their internship experience and how they won their university’s competition.

Corrected aerospace engineer resume summary

Recent Graduate with a Bachelor’s in Aerospace Engineering. Over 1 year of experience working as an intern at Boeing, which included assisting with a major study into designing more sustainable jet engines. Awarded First Place in a university Innovation in Undergraduate Engineering competition for designing an aircraft prototype made entirely from recycled materials.

Why is this correct?

In this corrected example, the applicant includes the same base information but with a lot more detail, context, and specificity. By doing so, the employer reading this summary gains a better overview of the applicant’s experience, specializations, and passions within the field.

3. Include a variety of key aerospace engineering skills

Including a skills section on your resume is crucial, as it gives you the opportunity to include abilities that your work experience section or resume summary may have overlooked.

When selecting which aerospace engineering skills to include on your resume, it is important to choose a mix of both technical and interpersonal skills. Technical skills are the more complex, learned abilities gained through education and training, while interpersonal skills deal with your emotional intelligence and ability to understand the people and world around you.

Keeping this in mind, here are 10 examples of both technical and interpersonal skills for aerospace engineers:

The best aerospace engineer hard skills to put on your resume

- Designing prototypes

- Production & manufacturing methods

- Knowledge of various aircraft

- Repair procedures

- Report writing & formal documentation

- Aircraft assembly

- Engineering software (cad, 2d & 3d modeling, etc.)

- Error investigations (malfunctions, aircraft crashes, etc.)

- Data collection & analysis

- Prototype & product testing

Effective interpersonal skills for your aerospace engineer CV

- Leadership

- Collaboration

- Innovation

- Time management

- Attention to detail

- Clear communication

- Creativity

- Problem-solving

- Negotiation

- Stress management

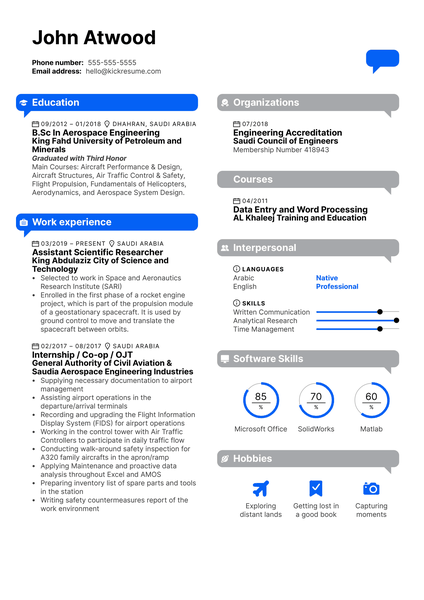

4. Describe your aerospace engineer work experience using concise bullet points

The work experience section of your resume is where you will have the best opportunity to provide in-depth descriptions of your past work experiences. Although it is important to provide adequate detail, you should also aim to keep these descriptions short and sweet.

To do this, use bullet points and one-sentence statements to structure your work experience descriptions. This will help to keep them concise and legible for employers, who will likely skim over the section rather than reading it word-for-word.

Here's an example of a work experience entry from an aerospace engineering resume

Naval Air Systems Command, Patuxent River, MD

Aerospace Engineer

April 2016 to May 2020

- Evaluated all designs for legal compliance and adherence to company safety standards.

- Created 20+ aircraft prototypes including designs for missiles, military aircraft, and satellites.

- Implemented a new aircraft repair process that decreased downtime for commercial aircraft by 15%.

5. List aerospace engineering educational credentials accurately

To become an entry-level aerospace engineer, you will need a minimum of a bachelor’s degree in aerospace engineering. However, to earn a higher-level (and higher-paying) position you will likely need a master’s degree.

No matter what educational credentials you have, always list your highest and most recent degree first, followed by the others in reverse-chronological order. Additionally, make sure to include the formal name of the degree, the university you attended, and your date of graduation.

Here is an example of a well-crafted education section on an aerospace engineering resume:

Massachusetts Institute of Technology, Cambridge, MA

M.S. in Aerospace Engineering

- Graduated: 2019, Magna Cum Laude

Duke University, Durham, NC

B.S. in Aerospace Engineering

- Graduated: 2016, Summa Cum Laude

6. Top resources for job-seeking aerospace engineers

Now that you know how to make your resume, let's put the theory to practice! Of course, before you get started on your resume, you need to know what job posting to apply for. If you don't know where to start looking, these resources may be of help:

- Industry-specific job boards: Explore platforms like Aeroindustryjobs, Space Careers, or Aerocontact for job listings, networking opportunities, and industry news tailored to aerospace engineers.

- Professional associations: Join associations like the European Space Agency (ESA), and the Royal Aeronautical Society (RAeS), or the American Institute of Aeronautics and Astronautics (AIAA) for access to the latest publications, networking events, and professional development resources.

- Aerospace companies' career pages: Check the career pages of major aerospace companies such as Boeing, Airbus, and SpaceX for job openings, internships, and graduate programs.

- Online learning platforms: Enroll in courses such as FEA Certification or CAD Certification to enhance your skills. Feel free to browse through Coursera, Udemy, or LinkedIn Learning for more courses.

- Job fairs and career events: Attend industry job fairs and career expos like UAA’s Virtual Aviation Career Fair, Aerospace Testing Expo, or AIAA SciTech Forum to meet recruiters, learn about job opportunities, and make connections with industry professionals.

Once you've found a job posting that speaks to you, read it carefully. Identify the key requirements and align them with your own skills and experiences. It's only then that you can put together a truly impactful and professional resume!

Aerospace Engineer Resume FAQ

How can I quantify my achievements on my aerospace engineer resume?

Quantifying achievements involves adding specific numbers, percentages, or metrics to your accomplishments to demonstrate the impact of your work. For example, you could quantify the number of aircraft designs you contributed to, the percentage increase in efficiency achieved through a project, or the cost savings realized from implementing a new engineering solution.

How can I effectively use keywords in my aerospace engineer resume?

Use keywords such as specific technical skills, industry terminology, and qualifications mentioned in the job description. Incorporating these keywords strategically can help your resume pass through applicant tracking systems (ATS). Always spell your keywords exactly as they appear in the job posting.

What are some common mistakes to avoid when crafting an aerospace engineer resume?

The most common mistakes include using generic or vague language, failing to tailor the resume to the job description, including irrelevant information, and neglecting to proofread for errors in spelling and grammar.

Should I include references on my aerospace engineer resume?

It's generally not necessary to include references on your resume. Instead, prepare a separate document with a list of professional references, which you can provide upon request or during your job interview.

Should I include a portfolio or samples of my work with my aerospace engineer resume?

Yes, including a portfolio or samples of your work can enhance your aerospace engineer resume, especially if you have tangible examples of projects, designs, or research you've completed. Consider creating an online portfolio website or including links to relevant projects, presentations, or publications to showcase your skills and accomplishments in greater detail.

![How to Write a Professional Resume Summary? [+Examples]](https://d2xe0iugdha6pz.cloudfront.net/article-small-images/i-Profile.svg)

![How to Put Your Education on a Resume? [+Examples]](https://d2xe0iugdha6pz.cloudfront.net/article-small-images/i-Collage-Universities.svg)

![How to Describe Your Work Experience on a Resume? [+Examples]](https://d2xe0iugdha6pz.cloudfront.net/article-small-images/Experience.svg)